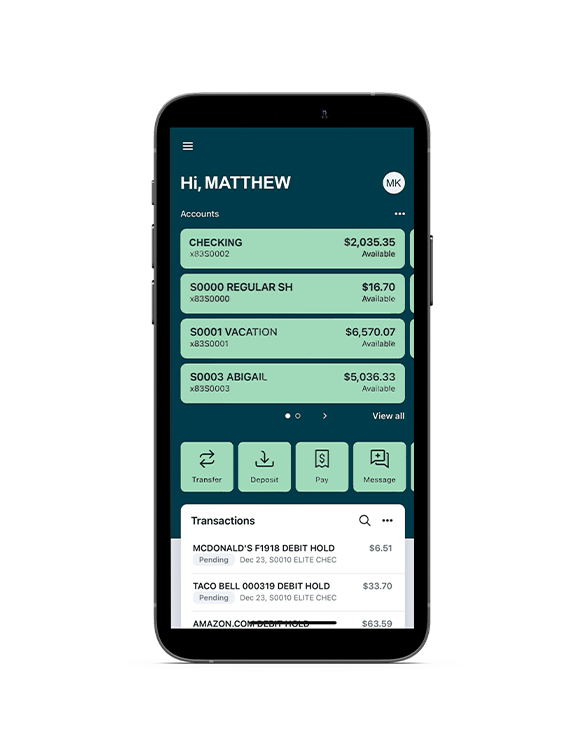

7 Digital Banking Features That Save You Money

• Mobile Check Deposits

Save time and gas money by depositing checks instantly from your smartphone.

• Automated Savings Programs

Round up purchases and automatically transfer spare change to savings accounts.

• Real-Time Spending Alerts

Prevent overdraft fees with instant notifications when account balances run low.

• Fee-Free ATM Networks

Access thousands of ATMs nationwide without paying withdrawal fees.

• Budgeting and Analytics Tools

Track spending patterns and identify areas where you can cut costs.

• High-Yield Online Savings

Earn significantly higher interest rates compared to traditional brick-and-mortar banks.

• Instant Money Transfers

Send and receive money instantly without wire transfer fees or delays.